|

Back to Contents Back to Contents

Your Benefits

What benefits will you receive when you retire?

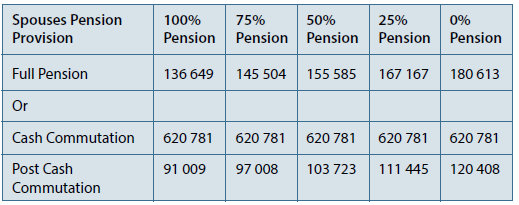

On retirement there are various options available to members. One year prior to

date of retirement a retirement quote will be generated which, in addition to the

Principal Member data, will also provide an indication of the pension available

depending on the options chosen at the time of retirement. These options, in

addition to providing a 100% pension option, also provide for a provision for the

spouse to receive a pension in the event of the death of the principal member. An

example of the various options is given in the two tables below:

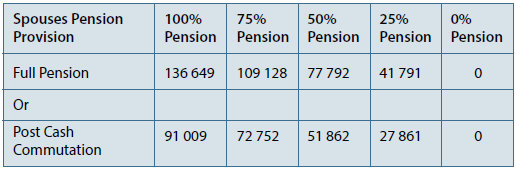

Based on the provision made and in the event of the death of the Principal

member, the spouses pension provision is as follows:

An explanation of the tables above is as follows: If a member opts for a pension

which makes provision for a 75% spouse’s provision, the member will receive a

full pension of R145 504 per annum. If, in addition to making the 75% spouse’s

provision, the member also takes the cash commutation, the pension payable to

the member will be R97 008 per annum. If the member predeceases his spouse,

the spouse will receive a full annual pension of R109 128 or a reduced annual

pension of R72 752 if a commutation is taken.

It should be noted that the examples given above presume that the commutation

is at the maximum permissible in terms of the Pension Funds Act. Members may

however choose any percentage of commutation up to 33.3%. By taking a lower

commutation value the annual pension payable will be enhanced. It should also

be noted.

What benefits will you receive if you leave your Employer’s service?

If you leave church service before you reach Normal Retirement Age you will

receive an amount equal to your Share of Fund.

The benefit can be taken in any of the following ways:

(i) as a cash lump sum; or

(ii) payment into a single premium retirement annuity; or

(iii) payment into a Pension Preservation Fund, or

(iv) transfer to your new Employer’s Fund subject to agreement between the

Funds.

It should be noted that there are tax liabilities that should be considered in the

event that the share of fund is taken in cash.

What benefits will your dependants receive if you die?

If you die in service before Normal Retirement Age, whilst a Member of the Fund,

your dependants will receive a payout equal to ten times your annual fund salary

as at date of death.

Following retirement an amount equal to seven times your fund salary as at date

of retirement will be paid to your dependants. The fund salary at date of retirement

continues to increase at the rate of pension increase on an annual basis.

Ill-health retirements

The Fund recognizes that there will be instances where members are forced to

take ill health retirement. There is a procedure in place for such eventualities and

requires medical reports from the member’s General Practioner, the Specialists

that have been consulted and a Member and Diocesan motivation for the illhealth

retirement.

|